Mistakes happen, even in payroll. Whether it’s overreported wages, miscalculated Social Security taxes, or a forgotten credit, the IRS gives employers a way to fix those errors: Form 941-X.

In this blog, we’ll break down everything you need to know about Form 941-X: the IRS form used to correct errors on a previously filed Form 941. From understanding when it’s needed, to how to fill it out correctly and avoid penalties, this guide will help you stay compliant and confident in your payroll tax processes.

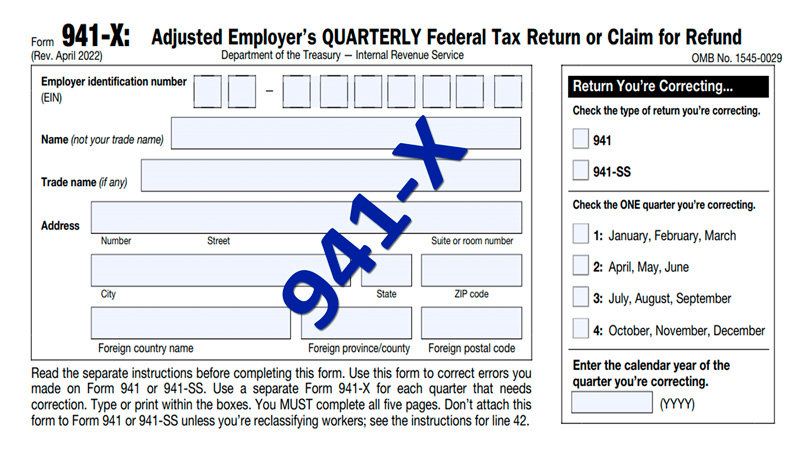

Form 941-X, officially titled ( Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund,) is used to correct errors on a previously filed Form 941.

Think of it as a fix-it tool for:

It’s not a replacement for Form 941, it’s only used to correct information already filed.

Use Form 941-X when you discover errors in your original quarterly tax return. This includes:

You must file Form 941-X within:

Each quarter that needs correction must be filed on a separate Form 941-X.

Form 941-X gives you two filing options:

Adjustment

Claim for Refund

If you're fixing an error that leads to tax overpayment, you can choose either method based on whether you want a credit applied to future returns or an actual refund.

Filing incorrect payroll taxes can lead to penalties, audits, or IRS notices. Form 941-X helps your business fix mistakes before they become major issues. It’s also vital for businesses that claimed COVID-related relief and now need to correct those amounts.

Form 941-X is your official way to correct payroll tax errors quickly and legally. Whether you're fixing overpaid taxes or adjusting missed credits, it helps keep your business compliant, clean, and protected.

If you’re unsure how to proceed, always consult with your payroll provider or tax advisor. PayProNext is here to guide you through the process, from spotting errors to filing Form 941-X accurately and on time. Contact us today at paypronext and let’s fix it together.

© Copyright PAYPRONEXT. 2025, All Rights Reserved.